In August 2022, President Biden made a major announcement that had millions of student loan borrowers across the country breathing a sigh of relief. His administration introduced a

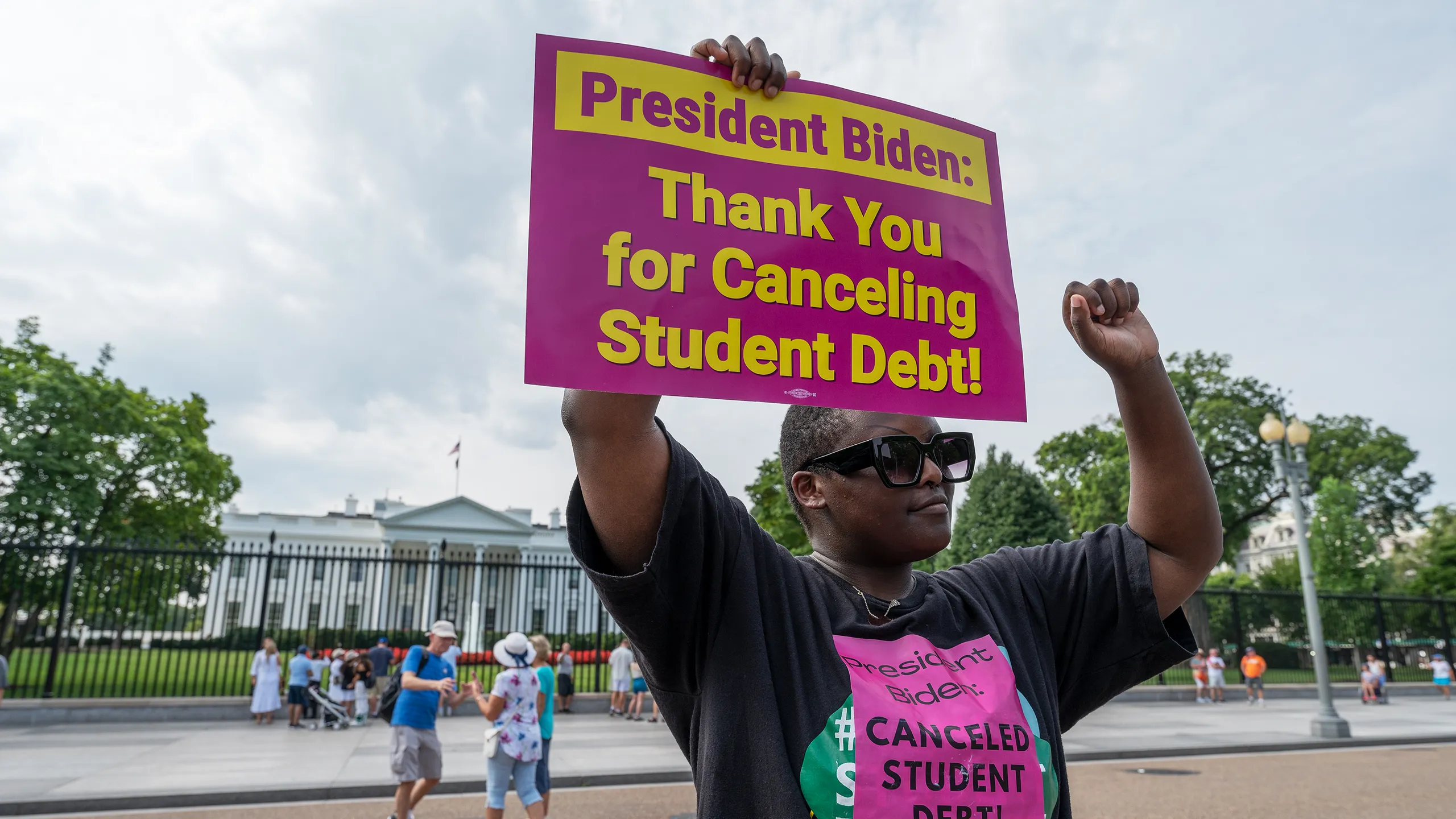

In August 2022, President Biden made a major announcement that had millions of student loan borrowers across the country breathing a sigh of relief. His administration introduced a student loan forgiveness plan that promised to erase a significant portion of debt for eligible students. But as with any government program, the devil is in the details, and many borrowers are left wondering how exactly they can benefit from this relief.

In this guide, we’ll walk you through the key points of Biden’s student loan forgiveness plan, how you can determine if you’re eligible, and the steps you need to take to apply for loan forgiveness. Whether you’re a current borrower or someone looking to plan your finances wisely, this article has all the essential information you need.

What Is the Student Loan Forgiveness Plan?

In a bid to reduce the crushing burden of student debt, President Biden’s student loan forgiveness plan offers up to $20,000 in loan forgiveness for qualifying borrowers. The exact amount you could see forgiven depends on several factors, including your income and whether you received a Pell Grant.

Key Details of Biden’s Loan Forgiveness Plan:

- Up to $20,000 in forgiveness for those who were Pell Grant recipients.

- Up to $10,000 in forgiveness for borrowers who didn’t receive a Pell Grant.

- Eligibility thresholds:

- Individuals with incomes under $125,000.

- Households with incomes under $250,000.

- Forgiveness applies only to federal student loans (private loans are not eligible).

- This is a one-time relief—there are no plans for recurring debt forgiveness under this program.

It’s important to note that this is a limited-time opportunity, and borrowers will need to act within the specified timeframes to benefit from it.

How Does the Plan Work?

The process for student loan forgiveness under Biden’s plan is relatively straightforward, but it depends on a few factors, such as whether the Department of Education has your income data on file.

Automatic Forgiveness

Around 8 million borrowers may be eligible for automatic relief because their income data is already on file. This typically applies to those who are enrolled in income-driven repayment plans or have submitted income information for other federal programs.

If you’re one of these borrowers, you don’t need to do anything; your loans will be forgiven automatically. However, it’s still a good idea to check your account and ensure that everything is up to date.

Application-Based Forgiveness

For the remaining eligible borrowers, you’ll need to submit an application. The Department of Education has developed a simple, online form to collect the necessary data.

Important Dates to Keep in Mind:

- October 2022: The application is expected to become available.

- November 15, 2022: Deadline to apply to ensure your forgiveness is processed before loan repayments resume.

- December 31, 2023: The final deadline for submitting your application.

Borrowers who complete the application process early could see their student loan forgiveness applied within four to six weeks.

How to Apply for Student Loan Forgiveness

Applying for student loan forgiveness may feel daunting, but the steps are fairly simple. Here’s what you need to do:

- Sign in to Your Student Aid Account

Visit StudentAid.gov and log into your account. Make sure your contact information is up to date, as this will be crucial for receiving any notifications about your loan forgiveness application. - Check If You Need to Apply

If the Department of Education has your income information on file, you may not need to apply. Otherwise, you’ll be required to fill out the online application. - Submit Your Application

Once the application becomes available in October 2022, you’ll need to provide your income information. The Department of Education has recommended applying by November 15, 2022, to ensure your loan forgiveness is processed before the current payment pause ends on December 31, 2022. - Monitor Your Account

Keep an eye on your loan servicer’s website and your Student Aid account to track the status of your forgiveness. You should receive updates via email or regular mail when your forgiveness is processed.

Who Qualifies for Student Loan Forgiveness?

Now that you know how to apply, it’s important to determine whether you qualify for the student loan forgiveness program.

To qualify, you must meet the following conditions:

- Income Requirements:

- Individuals must have earned less than $125,000 in 2020 or 2021.

- Households must have earned less than $250,000 in 2020 or 2021.

- Loan Type:

Only federal student loans qualify for forgiveness under this program. This includes Direct Loans and Department of Education-held loans. Private loans are not eligible for forgiveness. - Pell Grant Recipients:

Borrowers who received a Pell Grant are eligible for up to $20,000 in loan forgiveness. Those who didn’t receive a Pell Grant may qualify for $10,000.

It’s worth noting that these benefits are non-refundable, meaning if you owe less than the amount you’re eligible for, the excess amount won’t be refunded to you—it will simply erase your remaining balance.

What Happens After the Forgiveness?

Once your loans are forgiven, you may wonder what happens next. It’s simple: if the forgiven amount covers your entire balance, your loans are wiped clean, and you won’t owe anything further.

For borrowers with remaining balances after forgiveness, regular payments will resume starting in January 2023. The CARES Act, which paused payments and interest, will officially end in December 2022, so be prepared to resume your payments if your balance remains.

Will There Be More Student Loan Forgiveness in the Future?

While the current student loan forgiveness plan is a significant step forward, many are still wondering if more relief is on the way. Right now, it’s uncertain whether the Biden administration will introduce additional rounds of loan forgiveness.

There is always the possibility that Congress could pass more sweeping legislation in the future, but nothing is guaranteed. Borrowers should be cautious and avoid assuming more forgiveness will come.

The 2022 student loan forgiveness plan offers a once-in-a-lifetime opportunity to reduce your student debt significantly. Whether you’re eligible for $10,000 or $20,000 in forgiveness, the financial relief can be a game-changer. Be sure to act quickly, stay informed, and take the necessary steps to ensure your loan forgiveness is processed before deadlines pass.

Remember to keep an eye on your Student Aid account and your loan servicer for updates, and don’t hesitate to apply as soon as the process opens up. If you’ve been burdened by student debt, this relief could be just what you need to get back on track financially.

that promised to erase a significant portion of debt for eligible students. But as with any government program, the devil is in the details, and many borrowers are left wondering how exactly they can benefit from this relief.

In this guide, we’ll walk you through the key points of Biden’s student loan forgiveness plan, how you can determine if you’re eligible, and the steps you need to take to apply for loan forgiveness. Whether you’re a current borrower or someone looking to plan your finances wisely, this article has all the essential information you need.

What Is the Student Loan Forgiveness Plan?

In a bid to reduce the crushing burden of student debt, President Biden’s student loan forgiveness plan offers up to $20,000 in loan forgiveness for qualifying borrowers. The exact amount you could see forgiven depends on several factors, including your income and whether you received a Pell Grant.

Key Details of Biden’s Loan Forgiveness Plan:

- Up to $20,000 in forgiveness for those who were Pell Grant recipients.

- Up to $10,000 in forgiveness for borrowers who didn’t receive a Pell Grant.

- Eligibility thresholds:

- Individuals with incomes under $125,000.

- Households with incomes under $250,000.

- Forgiveness applies only to federal student loans (private loans are not eligible).

- This is a one-time relief—there are no plans for recurring debt forgiveness under this program.

It’s important to note that this is a limited-time opportunity, and borrowers will need to act within the specified timeframes to benefit from it.

How Does the Plan Work?

The process for student loan forgiveness under Biden’s plan is relatively straightforward, but it depends on a few factors, such as whether the Department of Education has your income data on file.

Automatic Forgiveness

Around 8 million borrowers may be eligible for automatic relief because their income data is already on file. This typically applies to those who are enrolled in income-driven repayment plans or have submitted income information for other federal programs.

If you’re one of these borrowers, you don’t need to do anything; your loans will be forgiven automatically. However, it’s still a good idea to check your account and ensure that everything is up to date.

Application-Based Forgiveness

For the remaining eligible borrowers, you’ll need to submit an application. The Department of Education has developed a simple, online form to collect the necessary data.

Important Dates to Keep in Mind:

- October 2022: The application is expected to become available.

- November 15, 2022: Deadline to apply to ensure your forgiveness is processed before loan repayments resume.

- December 31, 2023: The final deadline for submitting your application.

Borrowers who complete the application process early could see their student loan forgiveness applied within four to six weeks.

How to Apply for Student Loan Forgiveness

Applying for student loan forgiveness may feel daunting, but the steps are fairly simple. Here’s what you need to do:

- Sign in to Your Student Aid Account

Visit StudentAid.gov and log into your account. Make sure your contact information is up to date, as this will be crucial for receiving any notifications about your loan forgiveness application. - Check If You Need to Apply

If the Department of Education has your income information on file, you may not need to apply. Otherwise, you’ll be required to fill out the online application. - Submit Your Application

Once the application becomes available in October 2022, you’ll need to provide your income information. The Department of Education has recommended applying by November 15, 2022, to ensure your loan forgiveness is processed before the current payment pause ends on December 31, 2022. - Monitor Your Account

Keep an eye on your loan servicer’s website and your Student Aid account to track the status of your forgiveness. You should receive updates via email or regular mail when your forgiveness is processed.

Who Qualifies for Student Loan Forgiveness?

Now that you know how to apply, it’s important to determine whether you qualify for the student loan forgiveness program.

To qualify, you must meet the following conditions:

- Income Requirements:

- Individuals must have earned less than $125,000 in 2020 or 2021.

- Households must have earned less than $250,000 in 2020 or 2021.

- Loan Type:

Only federal student loans qualify for forgiveness under this program. This includes Direct Loans and Department of Education-held loans. Private loans are not eligible for forgiveness. - Pell Grant Recipients:

Borrowers who received a Pell Grant are eligible for up to $20,000 in loan forgiveness. Those who didn’t receive a Pell Grant may qualify for $10,000.

It’s worth noting that these benefits are non-refundable, meaning if you owe less than the amount you’re eligible for, the excess amount won’t be refunded to you—it will simply erase your remaining balance.

What Happens After the Forgiveness?

Once your loans are forgiven, you may wonder what happens next. It’s simple: if the forgiven amount covers your entire balance, your loans are wiped clean, and you won’t owe anything further.

For borrowers with remaining balances after forgiveness, regular payments will resume starting in January 2023. The CARES Act, which paused payments and interest, will officially end in December 2022, so be prepared to resume your payments if your balance remains.

Will There Be More Student Loan Forgiveness in the Future?

While the current student loan forgiveness plan is a significant step forward, many are still wondering if more relief is on the way. Right now, it’s uncertain whether the Biden administration will introduce additional rounds of loan forgiveness.

There is always the possibility that Congress could pass more sweeping legislation in the future, but nothing is guaranteed. Borrowers should be cautious and avoid assuming more forgiveness will come.

The 2022 student loan forgiveness plan offers a once-in-a-lifetime opportunity to reduce your student debt significantly. Whether you’re eligible for $10,000 or $20,000 in forgiveness, the financial relief can be a game-changer. Be sure to act quickly, stay informed, and take the necessary steps to ensure your loan forgiveness is processed before deadlines pass.

Remember to keep an eye on your Student Aid account and your loan servicer for updates, and don’t hesitate to apply as soon as the process opens up. If you’ve been burdened by student debt, this relief could be just what you need to get back on track financially.