In an unexpected turn of events, Tesla’s stock price surged, showcasing its resilience despite a fourth-quarter earnings miss that fell below Wall Street expectations. The electric vehicle giant, led by the ever-optimistic Elon Musk, closed its 2024 fiscal year with $25.7 billion in sales and adjusted earnings per share of $0.73, missing consensus analyst estimates which anticipated $27.3 billion in sales and $0.77 per share. Despite this, Tesla’s full-year revenue saw a modest increase to $97.7 billion, a 1% rise from the previous year’s record figures.

Tesla’s Strategic Outlook and Musk’s Bold Vision

Tesla’s stock reaction was nothing short of a rollercoaster, with shares dipping 5% in after-hours trading before climbing by 5% at the market’s open the following day. This volatility highlights the market’s mixed reaction to Tesla’s financial health juxtaposed against its ambitious future plans.

“I’m not saying it’s an easy path, but I see a path for Tesla being the most valuable company in the world by far,”

Musk remarked during Wednesday’s earnings call. He envisions Tesla outpacing the combined value of the next top five companies, teasing a staggering $10 trillion revenue potential with projects like the Optimus humanoid robots.

Analysts Baffled by Market Reaction

The market’s surprising response has left even seasoned analysts scratching their heads. Adam Jonas from Morgan Stanley and Ryan Brinkman from JPMorgan expressed confusion over the stock’s performance, noting a detachment from the fundamental financial metrics.

“The move higher in Tesla shares bore no relation whatsoever to the company’s financial performance in the quarter just completed or to its outlook for growth in the coming year,”

Brinkman critically noted, highlighting the stock’s seemingly irrational exuberance.

Forward-Looking Initiatives and Technological Advances

Amidst financial turbulence, Tesla plans to spearhead the production of its “Cybercab” driverless taxi in the upcoming year and aims to ramp up the manufacturing of its more affordable vehicle models by the first half of 2025. These initiatives are part of Tesla’s strategy to return its core vehicle business to growth and sustain investor interest through technological innovation and expanded production capabilities.

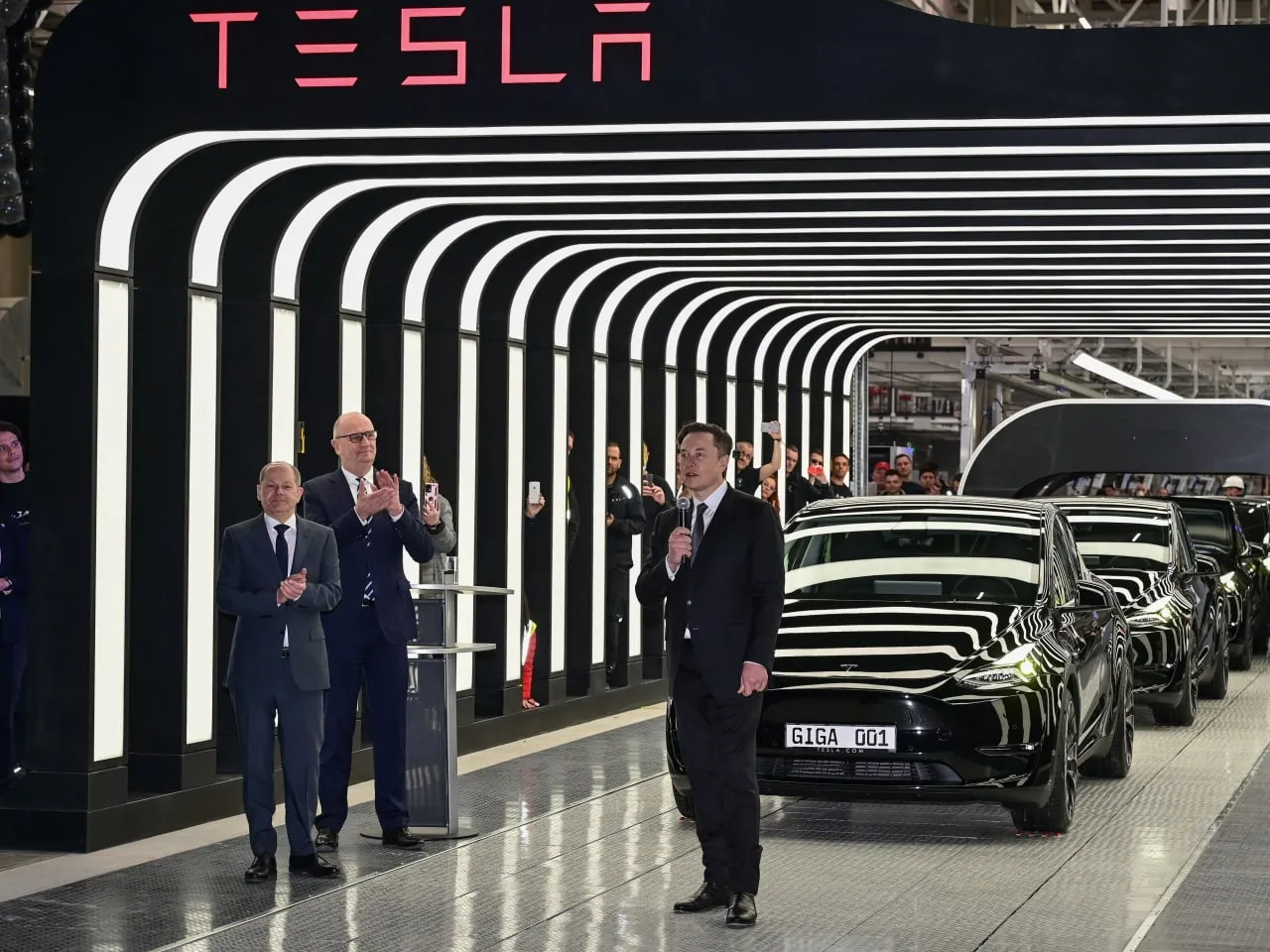

Tesla’s Influence and Musk’s Controversial Moves

Tesla’s stock rise also paralleled significant political events, notably Donald Trump’s election victory, which likely influenced regulatory perspectives favorable to Tesla’s business model. Elon Musk’s close relationship with Trump and his active political engagements have been as newsworthy as they are controversial, sometimes overshadowing corporate accomplishments.

Musk’s Financial Empire and Future Aspirations

Elon Musk, currently the richest individual globally with a net worth exceeding $410 billion, continues to draw significant value from his 13% stake in Tesla. His interests in other ventures like the generative AI startup xAI and SpaceX contribute to his sprawling financial empire, underscoring his influence across multiple technology domains.

Tesla’s journey through financial complexity and market unpredictability highlights a year of contrasts—stagnant profits against the backdrop of promising technological advancements and robust market performance. As Tesla navigates these turbulent waters, the industry watches closely, anticipating its next moves in an ever-evolving automotive landscape.