In a startling turn of events, the AI sector experienced one of its most dramatic days as Nvidia’s stock plummeted by 17%, erasing $600 billion in market value. This was triggered by the emergence of DeepSeek, a Chinese AI start-up, introducing a new AI model that significantly undercuts costs while matching the performance of leading technologies like OpenAI’s ChatGPT. Nvidia, a titan in the AI chip market, found its supremacy questioned, stirring a broad sell-off in AI-related stocks.

DeepSeek: A New Contender Emerges

Founded by hedge fund chief Liang Wenfeng in May 2023, DeepSeek is turning heads with its R1 model. This model, which operates on less advanced chips, accomplishes tasks at a fraction of the cost estimated at just $2.19 per million tokens compared to OpenAI’s $60. The start-up’s approach uses an open-source framework, allowing for broader development and adaptation, challenging the proprietary nature of its competitors’ models.

Despite its innovative cost efficiency, DeepSeek has faced accusations from OpenAI of using distillation—a method that simplifies the training of AI models by copying larger models—allegedly violating OpenAI’s terms of service. Such controversies highlight the competitive and murky waters of AI development, where intellectual property rights and ethical practices are continually being tested.

The Market Reacts

The market’s reaction to DeepSeek was severe yet possibly premature. Investors quickly moved away from Nvidia and other AI stocks, reflecting the uncertainty and potential shifts in the AI industry’s dynamics. However, Nvidia’s quick recovery of some losses suggests a belief among some investors that the initial response might have been an overreaction.

Microsoft’s incorporation of DeepSeek into its Azure cloud service lends the start-up a significant credibility boost, despite ongoing debates about the true cost and technological independence of its innovations. The support from a major player like Microsoft could be indicative of a broader industry acceptance of DeepSeek’s potential to alter the AI landscape.

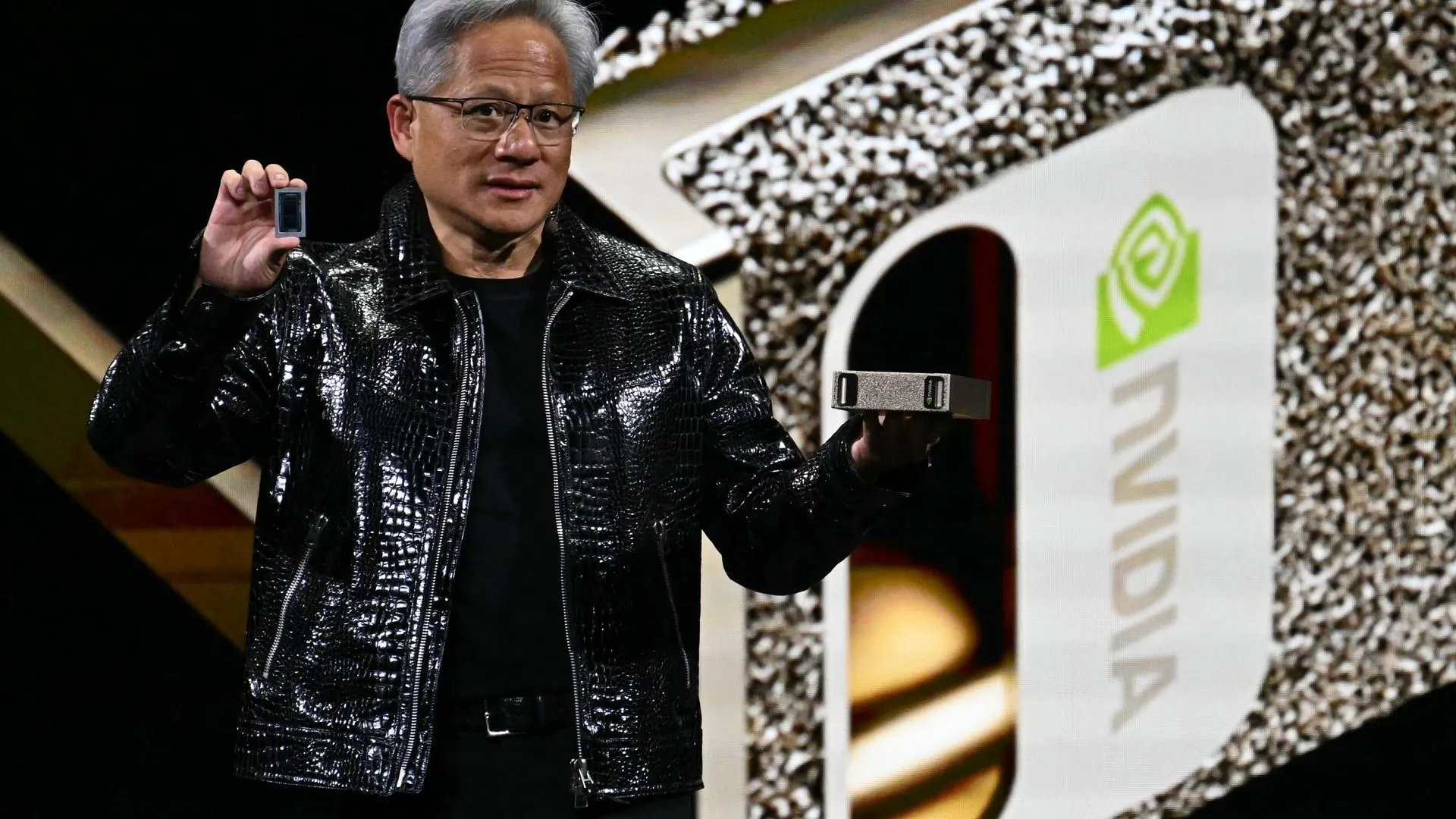

Nvidia’s Long-Term Prospects

Despite the upheaval, it’s crucial to recognize Nvidia’s enduring strength in the AI sector. Its technological innovations and adaptability have seen it move from video games to AI and autonomous vehicles, continually proving its resilience and capacity to lead.

The adoption of more efficient, open-source architectures, as demonstrated by DeepSeek, might initially seem like a threat to Nvidia. However, according to the Jevons Paradox, as AI becomes cheaper to operate, its use could proliferate, potentially increasing overall demand for Nvidia’s AI chips, albeit at lower prices.

Moreover, the geopolitical landscape, notably the tech cold war between the U.S. and China, might also play a critical role in shaping the future of companies like Nvidia and DeepSeek. The U.S. government’s response to DeepSeek’s rise and its implications on international trade and security could have as much impact on Nvidia’s fortunes as the technological advancements themselves.

Final Thoughts

As the dust settles on this landmark event in the AI industry, investors and tech enthusiasts alike should watch closely. Nvidia’s journey has been marked by innovation and strategic pivots. Whether this latest challenge spurs further innovation or leads to a strategic reassessment, the path forward will undoubtedly be as dynamic as the technology driving it.