As the space industry continues its rapid expansion, Rocket Lab positions itself as a formidable player, clearly delineating its growing influence and market share with impressive third-quarter earnings that not only surged past expectations but also highlighted the company’s robust future prospects. The results, released late Tuesday, have set the stage for what appears to be another lucrative period, with shares jumping nearly 22% following the announcement.

A Closer Look at Rocket Lab’s Financials and Future Outlook

Rocket Lab, often cited as a direct competitor to Elon Musk’s SpaceX, has reported a notable increase in revenue, soaring 55% to reach $105 million for the quarter, significantly outstripping FactSet’s prediction of a 51% rise to $102.3 million. While the company did report a widening loss—from 8 cents per share last year to 10 cents—this was still better than the anticipated 11 cents per share loss. This performance underlines the company’s ability to manage its growth trajectory effectively despite the cost-intensive nature of the aerospace sector.

The company’s financial health is further underscored by its backlog, which now stands at $1.05 billion, nearly reaching the analyst estimates of $1.1 billion. This robust pipeline signals strong continued demand for Rocket Lab’s services and points to sustained revenue streams going forward.

Rocket Lab’s Strategic Advances in the Space Race

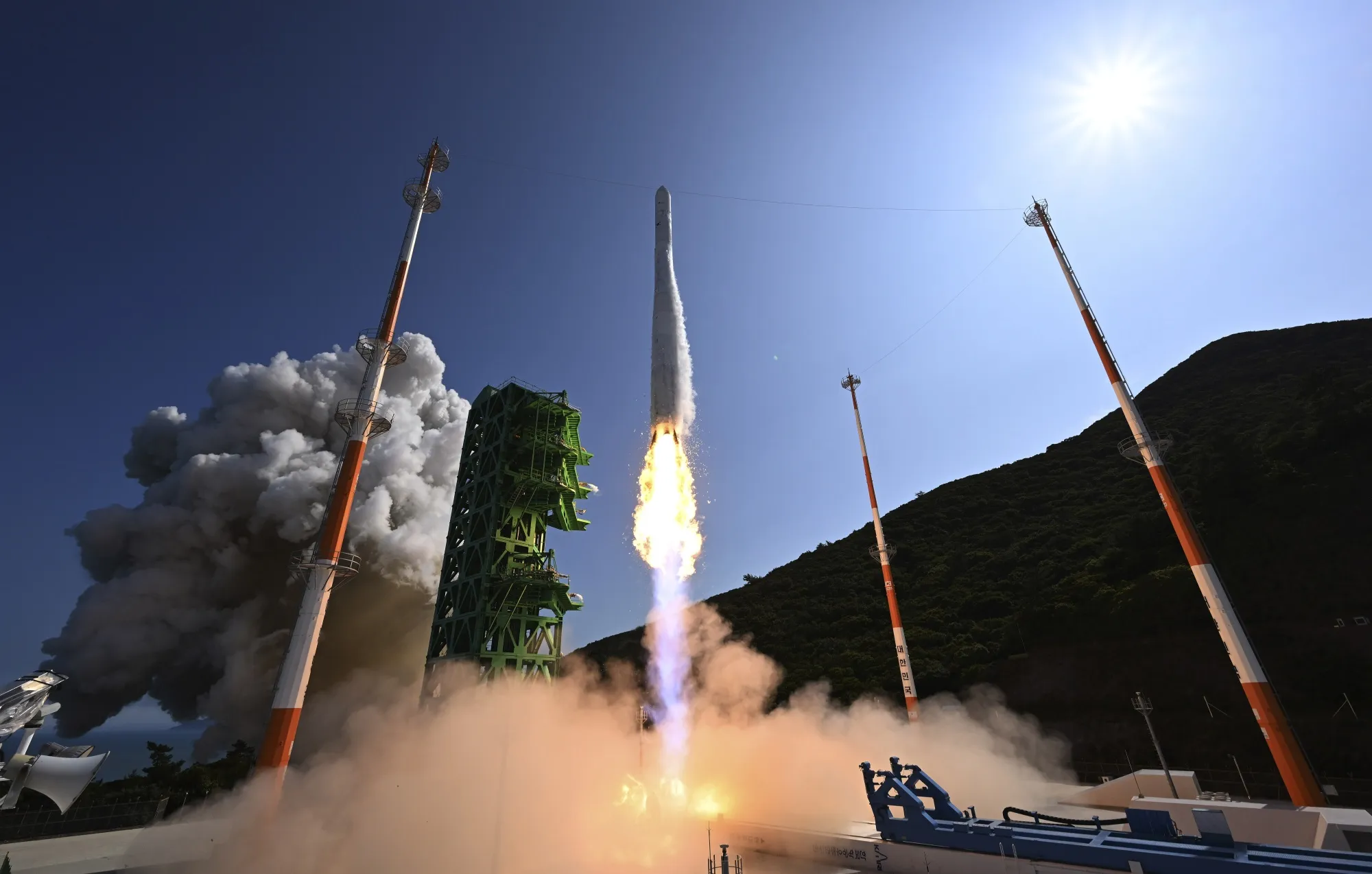

In 2024, Rocket Lab’s Electron rocket has been recognized as the third most-frequently launched rocket globally, trailing only behind industry giants SpaceX and China. This is a testament to the company’s operational capabilities and its growing reputation as a reliable launch provider.

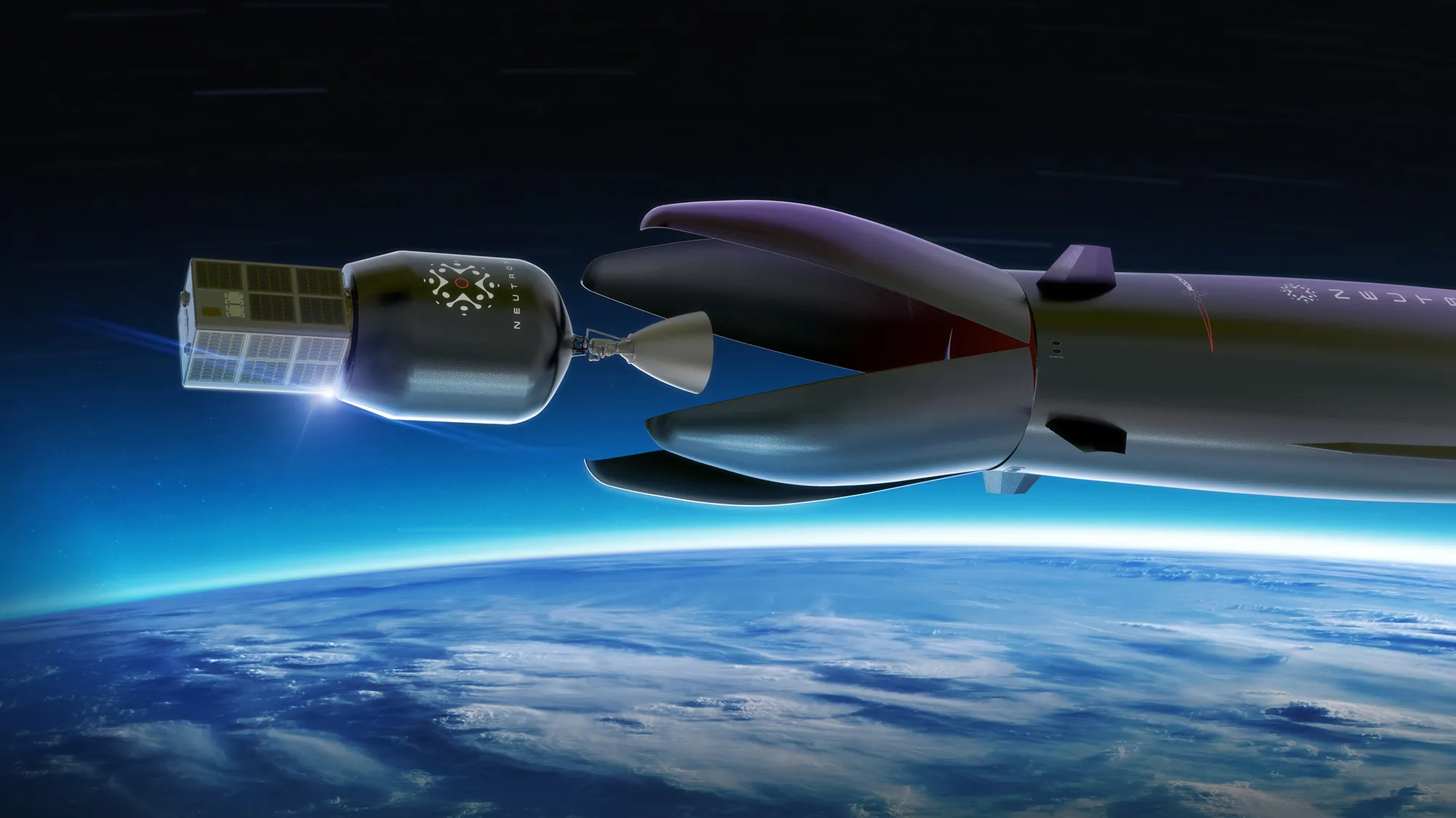

Looking forward, Rocket Lab has set an ambitious revenue target for Q4, forecasting between $125 million and $135 million, which would surpass the FactSet estimates of $121 million. This optimism is driven by several strategic initiatives, including a new launch service agreement with a confidential commercial satellite constellation operator. This deal involves Rocket Lab’s medium-lift rocket, Neutron, which is slated for its maiden voyage in 2025. The Neutron rocket is particularly significant as it is expected to be a part of the U.S. Government’s National Security Space Launch (NSSL) Lane 1 program, potentially tapping into a contract valued at $5.6 billion over five years.

Market Response and Industry Implications

The market has responded enthusiastically to Rocket Lab’s recent announcements, with RKLB stock experiencing a significant spike post-earnings announcement, despite a slight downturn during the regular session on Tuesday. The stock has risen an impressive 165% this year, reflecting investor confidence in the company’s trajectory and the space sector’s overall growth.

As Rocket Lab continues to expand its footprint in the industry, it is projected that over 10,000 satellites will require launch services by 2030. The company estimates that the total addressable market for these services could balloon to about $10 billion, positioning Rocket Lab not just as a service provider but as a key player in the broader logistics of space exploration and commercialization.

Looking at the Competition: AST SpaceMobile’s Upcoming Report

In related industry news, AST SpaceMobile, another key player in the space sector and a partner of SpaceX, is also scheduled to report its Q3 results late Thursday. The market anticipates that the satellite manufacturer and telecommunications firm will announce an improved financial stance compared to the previous year, with expectations set for a loss of 23 cents per share on sales of $1.8 million.

As the space sector continues to evolve, Rocket Lab’s achievements and strategic positioning suggest a promising future, potentially reshaping how we approach space exploration and satellite deployment. With each successful launch and financial milestone, Rocket Lab not only advances its own prospects but also propels the entire industry forward into new realms of possibility.